The world of e-commerce has been growing at an unprecedented rate over the past decade, with Amazon being one of the most dominant players in the market. As a result, buying an established Amazon business has become an increasingly popular option for entrepreneurs looking to enter the online retail space. While there are certainly benefits to acquiring a pre-existing Amazon business, it is important to carefully consider both the advantages and challenges before making such a significant investment.

This article will provide an objective analysis of whether buying an Amazon business may be right for you. We will examine some key factors that should be taken into account when considering this option, including financial considerations and potential challenges that you may face as a new owner. By understanding these factors, readers will have a better idea of whether purchasing an existing Amazon business aligns with their goals and capabilities.

Benefits of Buying an Amazon Business

The advantages of acquiring an established online enterprise that operates within the world’s largest e-commerce platform can offer a range of benefits, including revenue diversification and increased market share. Acquiring an Amazon business allows investors to leverage the already established customer base and brand recognition of the target company. This can reduce the time and effort required to build a new business from scratch, which translates into cost savings and faster entry into the marketplace.

Furthermore, due diligence in selecting an appropriate Amazon business for sale with high growth potential can lead to higher returns on investment when compared to starting a new venture. An existing business has already navigated through initial challenges such as product development, supply chain management, and customer acquisition. By acquiring a well-performing Amazon business that aligns with one’s interests or expertise, investors can focus on scaling operations while minimizing uncertainties associated with start-ups. Therefore, purchasing an Amazon business presents opportunities for entrepreneurs who seek to expand their portfolio or enter a new industry without taking on significant risks associated with launching a new enterprise from ground zero.

Challenges of Buying an Amazon Business

Navigating the hurdles of purchasing an Amazon-based enterprise can feel akin to crossing a treacherous minefield, with numerous obstacles and potential setbacks that must be tactfully overcome. One of the biggest challenges is conducting thorough due diligence on the business before making a purchase. This includes analyzing financial records, assessing inventory levels, evaluating customer feedback, and reviewing seller agreements. Failure to conduct proper due diligence can lead to unexpected costs or legal issues down the line.

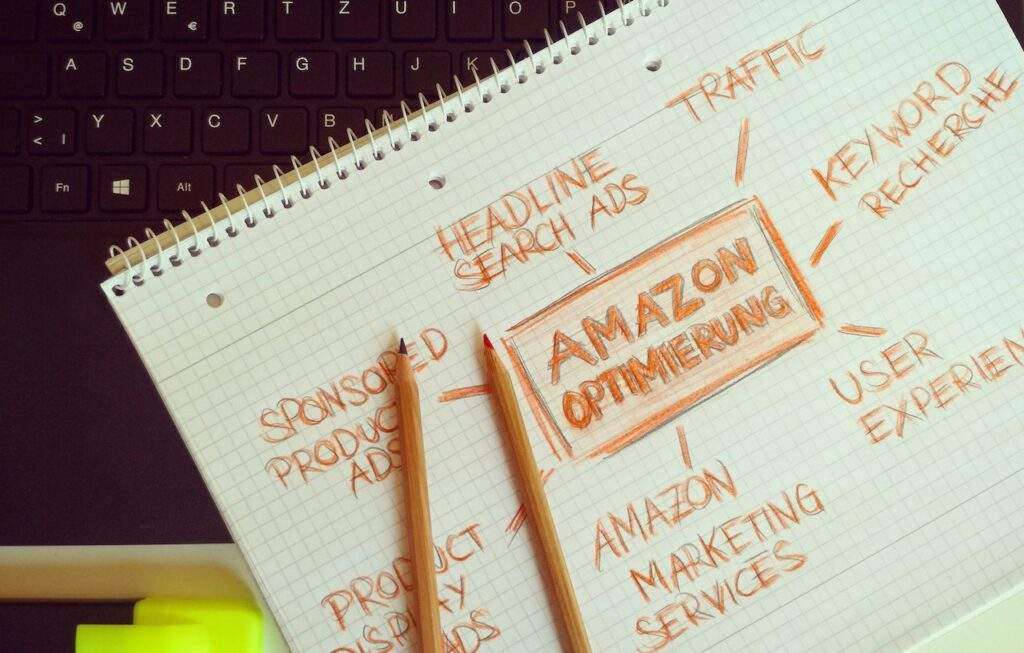

Another challenge is managing risk in a constantly changing marketplace. Amazon’s policies and algorithms are subject to frequent updates, which can impact sales rankings or even result in account suspension. It’s important for buyers to understand these risks and have contingency plans in place. Additionally, competition on Amazon can be fierce, requiring constant optimization of listings and advertising campaigns to maintain visibility and sales volume. Buyers must be prepared for this level of commitment and effort if they wish to succeed as Amazon sellers.

Financial Considerations

Examining the financial aspects of purchasing an Amazon-based enterprise is crucial for potential buyers to make informed decisions and mitigate risks. One of the significant financial risks when buying an existing Amazon business is overpaying for it. Inexperienced buyers may be willing to pay a premium price based on the seller’s claims about revenue, profitability, and growth potential without verifying these assertions through proper due diligence. To avoid overpaying, buyers should conduct thorough research into the business’s finances, including reviewing its sales history, profit margins, expenses, inventory turnover rates, and customer feedback.

Another important financial consideration is investment returns. While there are many opportunities to earn a lucrative income from selling on Amazon, not all businesses generate substantial profits or provide long-term returns on investment. Therefore, it is essential to evaluate the business’s future growth prospects and determine whether it has a competitive advantage in its niche market. Additionally, buyers should assess their own ability to manage and grow the business effectively as they will need to invest time and resources into optimizing operations such as product sourcing strategies, marketing campaigns or inventory management systems. Overall, examining financial factors before buying an Amazon-based enterprise can help ensure that investors make informed decisions that align with their goals and risk tolerance levels.

Is Buying an Amazon Business Right for You?

Ironically, one may assume that purchasing an enterprise on Amazon is a straightforward decision; however, it requires a careful evaluation of personal goals and objectives to determine if the investment aligns with their long-term financial plans. Market analysis is an integral aspect of this process as it helps assess the potential profitability of the business. Conducting due diligence is also crucial to ensure that all aspects of the business are transparent and legitimate.

Before making any investment decisions, potential buyers must evaluate their skills and resources. Running an Amazon business requires knowledge of e-commerce platforms, digital marketing strategies, and inventory management techniques. Additionally, buyers must have access to capital for purchasing inventory, paying suppliers and employees, as well as investing in advertising campaigns. With these considerations in mind, individuals can adequately assess whether buying an Amazon business aligns with their long-term goals and objectives.

Frequently Asked Questions

What are the legal and administrative procedures involved in buying an Amazon business?

When considering the purchase of an Amazon business, it is crucial to conduct due diligence and engage in contract negotiation to ensure a smooth transition. Due diligence involves conducting a thorough investigation into the seller’s financials, operations, and legal compliance. It may also include reviewing customer reviews and feedback to gauge the business’s reputation. Contract negotiations involve discussing terms such as price, payment structure, non-compete clauses, and warranties.

A comprehensive agreement should address all aspects of the transaction and protect both parties’ interests. Failing to complete these legal and administrative procedures can result in costly mistakes and potential litigation down the line. Therefore, it is essential for prospective buyers to approach buying an Amazon business with careful consideration and proper preparation.

How do I determine the value of an Amazon business before making a purchase?

To determine the value of an Amazon business before making a purchase, it is essential to understand profitability and identify growth potential. Profitability can be gauged by analyzing financial statements such as income statements, balance sheets, and cash flow statements. A thorough assessment of these documents helps in determining the revenue generated by the business and its expenses.

Identifying growth potential involves evaluating aspects such as customer base, product demand, competition analysis, and market trends. Conducting a SWOT analysis (Strengths, Weaknesses, Opportunities, and Threats) provides a comprehensive view of the business’s strengths and weaknesses while highlighting opportunities for growth. Understanding these factors allows prospective buyers to make informed decisions about the value of an Amazon business before making a purchase.

What are some common mistakes to avoid when buying an Amazon business?

When buying an Amazon business, it is crucial to conduct due diligence. It is important to engage in financial planning to avoid common mistakes. Due diligence refers to the process of researching and verifying information about the business, its operations, financials, and legal obligations. It helps identify any potential risks or red flags that may affect the viability of the investment. Financial planning involves creating a budget, projecting revenue streams, estimating expenses and profits, and identifying funding sources.

Common mistakes to avoid include not conducting thorough due diligence, underestimating expenses or overestimating revenue projections, failing to consider market trends or competition, ignoring legal requirements or tax obligations, overlooking hidden costs such as inventory storage fees or shipping charges, and not having a solid exit strategy. By taking these factors into consideration during the buying process, investors can make informed decisions that maximize their chances of success.

How do I ensure that the seller is legitimate and the business has a good reputation?

The process of verifying the legitimacy of a seller and assessing the reputation of an Amazon business is crucial for potential buyers. To ensure that the seller is legitimate, one can perform a background check on the individual or company, review their credentials and references, and examine their online presence. Reputation checks involve analyzing customer feedback, ratings and reviews, product quality, brand recognition, and overall sales performance. These steps are essential to avoid fraudulent activities or scams that may lead to financial losses or a tarnished brand image. Conducting thorough due diligence before purchasing an Amazon business can help mitigate risks and increase the likelihood of a successful acquisition.

What are the potential risks and liabilities associated with buying an Amazon business?

When considering the potential risks and liabilities associated with buying an Amazon business, financial considerations and due diligence are critical. Financial considerations include evaluating the seller’s financial statements, cash flow projections, and tax returns to determine if the asking price is reasonable and whether the business can generate sufficient income to cover expenses.

Due diligence involves assessing legal issues such as intellectual property rights, contracts with suppliers or customers, compliance with regulations, and any pending lawsuits or claims against the business. Additionally, examining customer feedback and ratings on Amazon can provide insights into how well the business has performed in terms of customer satisfaction. Thoroughly researching these factors before making a purchase decision can help mitigate risks associated with buying an Amazon business.

Conclusion

The decision to buy an Amazon business is not one that should be taken lightly. There are benefits, such as the potential for passive income and a pre-established customer base, but there are also challenges, such as the risk of acquiring a poorly performing business and the need to stay on top of constantly changing Amazon policies. Financial considerations must also be taken into account, including the initial investment and ongoing expenses. Ultimately, whether or not buying an Amazon business is right for you depends on your individual goals and circumstances.

In conclusion, before deciding to buy an Amazon business, it is crucial to thoroughly research both the benefits and challenges involved. Ask yourself if you have the time and resources to effectively manage an Amazon business in a competitive marketplace. Consider your financial situation and whether or not investing in an established business aligns with your long-term goals. Ultimately, making informed decisions based on careful consideration will increase your chances of success in this dynamic industry. So, are you ready to take on the challenge of owning an Amazon business?